It seems like a crazy idea – someone can actually make too much money to file bankruptcy, but in the case of a Chapter 7, that can happen. It’s all because of a form called a Means Test that must be filed whenever anyone is above median income for the state in which they reside.

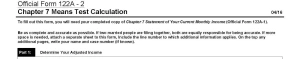

When the U.S. Bankruptcy Code was amended in 2005, Congress decided that every individual requesting relief under Chapter 7 would have to meet certain income requirements to be eligible. If your household is below the average income for your area, you can file a Chapter 7. If your household is over the average income for your area, you must go through what is commonly called a Means Test to be qualified to file a Chapter 7. Unfortunately, this calculation is controlled by the U.S. Bankruptcy Code and not what you actually spend. Therefore, it is possible for individuals to make too much money to file a Chapter 7 and still be in dire need of filing bankruptcy.

This is why you need an experienced attorney to determine if you can file a Chapter 7. If you file a Chapter 7 when you actually do not “pass” the means test, the U.S. Trustee will file a motion to dismiss your case or convert it to a Chapter 13 case because it is presumed that your case constitutes abuse of the U.S. Bankruptcy Code. Sound confusing? Yes it is!

Fortunately, Chapter 13 is a great option for people who “make too much money” to file a Chapter 7. You may have to pay some of your unsecured debts back in a Chapter 13, but it is always better than getting sued by creditors and possibly getting garnished. Neither of those things can happen to you if you file a Chapter 13. Additionally, there are other savings in what you have to pay back to unsecured creditors because they are not entitled to receive any interest on the amount owed after you file a Chapter 13. You may also be able to “cram down” certain secured personal property debts such as car loans and further save money.

There are no income limits on who can file a Chapter 13, but there are debt limits. To be eligible to file for Chapter 13 bankruptcy, an individual must have no more that $394,725 in unsecured debt such as credit card bills or personal loans. They also can have no more than $1,184,200 in secured debts, which includes mortgages and car loans. The majority of Americans fall below these debt limits. Chapter 13 is literally the silver lining in the cloud when you make too much to file a Chapter 7 bankruptcy.